Sam Whitaker bought his first house the same summer his radiator died twice. The place wasn’t much, with three bedrooms, a tired maple out front, shingles that had seen better years, but it was his. The realtor didn’t have to work hard on the speech. One lightning strike. One kitchen fire. One slip and fall on the front steps. That was enough. Sam went home and typed “home insurance quotes” into a browser that still remembered dial-up. He picked the mid-priced policy that promised peace of mind because that sounded like a thing you could buy.

He stuck with it for decades. He learned how to snake a drain, replace a garbage disposal, and caulk a window against winter. He learned what a deductible really feels like the first time his kid cracked a windshield, and he learned to keep receipts because documentation helps even when he never filed a claim. Years slid by. The beat-up hatchback he drove when he signed the mortgage became a decent sedan and then a nice set of wheels with heated seats, which felt like a raise even when it wasn’t. The kids grew into teenagers who slept through everything, including storms that rattled gutters like dice.

Every month, the premium left his account. It was easy to ignore because it always left on time. He joked once that he had put his agent’s kids through college. The agent laughed and said that was not how it worked. Then the agent mentioned a backyard pool and a new SUV, and Sam laughed less. Still, he told himself, that’s the deal. You pay, and you hope you never need it. Home insurance quotes buy a promise. It’s not romantic, but it’s adult.

The first sign of trouble came with a letter that didn’t sound like him. It sounded like a committee. Routine aerial assessment identified potential concerns with roof condition, it said. He called his agent.

The agent said, “It’s nothing, just a formality. But while I got you on the phone, can you trim back the branches so we can get a better look up there?”

The conversation was odd. Sam definitely felt that something was wrong. It was a strange request. First of all, if he wanted a tree to cover his house, that was his business. But the conversation took an ugly turn when his agent he had known for years told him that the consequences for not complying with this request would result in the loss of insurance. Period. End of discussion.

Sam stood in the driveway with a handsaw and felt ridiculous, but he did it. He rained leaves on his front walk and pulled a branch so big it left a crescent scar on the lawn. He took pictures of the newly exposed shingles. Faded, yes. But not curling. Not in bad shape. He emailed them in with the polite subject line people use when they still believe the world is reasonable.

Two weeks later, an envelope as thin as a threat arrived. We regret to inform you that your policy will not be renewed due to roof wear and deferred maintenance. No claim. No leak. No ladder on the house. Just a drone flight and a decision. He called the agent.

The agent said, “My hands are tied.”

Sam asked, “What maintenance?”

The agent said, “It’s in the photos.”

Sam looked. He saw sunlight and shingles and the life of a roof. He didn’t see deferred anything.

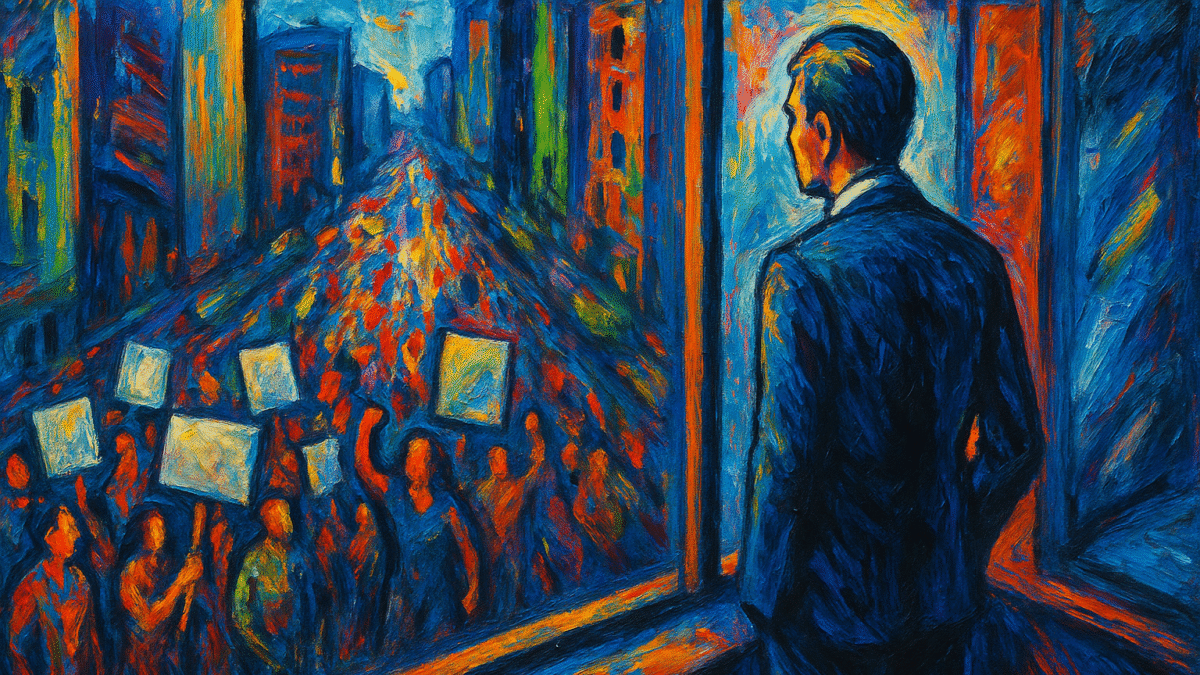

Sam did what everyone does when the future gets yanked. He went back online and typed home insurance quotes again. The search results were brighter than he remembered, like a casino. We’ve got you covered. Save in minutes. Protect what matters. He filled out forms. He learned to click no on questions that assumed he was a risk. He learned that once one company flags you, the others smell smoke. The new quotes were higher. The deductibles were steeper. The friendly mascots smiled anyway.

He called to appeal. He asked for a human who could stand on his roof with him and talk about granules and underlayment, and years left. The person on the phone said Sir a lot. Sir, the imagery is conclusive. Sir, the decision is final. Sir, we appreciate your loyalty. Sir, I understand your frustration. Sir, have you considered replacing the roof to be eligible for reconsideration?

He asked, “So, you’re asking me to pay ten grand to keep paying you?”

The line was quiet for a second. Then the agent said, “It sounds bad when you say it that way. But it is an option.” He wasn’t able to get through to the agent he had known for years. He was being directed to anonymous agents he had never heard.

Sam exploded, “I have given you money for years, enough to fix the roof ten times over. But when it comes time for you to deliver on the promise you made me years ago, you find a way to weasel out of it? What would make you think I believe anything you have to say now?”

It was not that Sam didn’t believe in fraud. He worked long enough in shipping to know people do what they think they can get away with. He had seen staged falls on loading docks. He had heard about arson that looked like mercy. But this was not that. This felt cleaner and meaner. This felt like a business model. Collect premiums for years, and right before we have to cut a check, find a way to get out of it. We didn’t get into the business to give anyone their money back. What kind of racket would it be if we ended up doing that?

On Saturday, Sam climbed the pull-down ladder to the attic with a flashlight in his teeth. No damp wood. No daylight where it shouldn’t be. He ran his palm over rafters, feeling the splinters that roofs collect from years of being a roof. He was not naïve. The shingles were old. But old is not a catastrophe. Old is what a policy is for when a storm decides to get rough. He took more pictures. He sent them anyway. The reply auto acknowledged his concern and thanked him for his partnership.

At dinner, his daughter asked if they were moving. He said no and forced a smile that hurt his jaw. After she went to her room, he opened a notebook and wrote down numbers, the cost of a roof, the new premiums, the mortgage balance, the savings that were supposed to be for other things. He wrote options on one side and came up with two. Replace the roof to keep a company that only wanted his money. Or keep searching home insurance quotes until he finds a policy priced like punishment. He circled replace because at least the roof would be real.

Then, he questioned if he actually needed insurance.

He scheduled the work and watched three guys with nail guns move across his house like a storm in reverse. New shingles. New flashing. New language in his head about wind ratings. He took another photo from the sidewalk. The maple, freshly shorn, framed the roof like the border of an apology.

The agent called after the job was done. “Great news,” he said. “You are eligible for renewal.”

Sam waited for the feeling and didn’t find it. He said, “I’m not sure I need you. Give me one reason why I would send you any more money after what you’ve put me through all these years.”

Sam could hear the smile on the agent’s face disappear. He didn’t get an answer right away because there was some hemming and hawing that had to take place first, “Well, if your house should happen to burn down or if a flood comes through and it ends up floating away, that’s what we’re here for.”

“You were here for a whole lot more than that when I first started paying this policy,” Sam said with a tired and defeated tone. “You just keep coming up with empty promises and finding ways to break them. Tell your wife and kids I said hello.”

Within the hour, the renewed policy showed up in his email. The premium had climbed anyway. Loyalty, it turned out, meant starting fresh at a higher rate with a company that had just auditioned as his enemy.

That night, Sam reread the first brochure he saved all those years ago when he was still scared of everything that could go wrong. It promised peace of mind in a font that looked like a handshake. He thought about the little frauds people commit. Then, he thought about the big fraud his insurance company had become. Drones that never knock. The word risk is a coin that only buys one side of the bet.

In the morning, he changed his auto pay settings and set a reminder six weeks before his renewal date to shop “home insurance quotes” like a man who knows what promises cost. He still believes in insurance the way you believe in seat belts. But he no longer believes in the notion that you are the risk and they are the rescue. He knows now that the promises were nothing but a lie, and insurance companies aren’t there to add a layer of protection but to make a profit. Their bottom line is all that matters to them.

Imagine a company that actually cared and delivered what it promised. What a world that would be, huh?

This insurance claim is based on a true story.

If you love The Big Bang Theory, you might like Leonard and Sheldon: The Big Bang Theory Reimagining